Some Known Facts About Life Insurance.

Table of ContentsThe smart Trick of Life Insurance That Nobody is DiscussingAn Unbiased View of Life InsuranceThe Facts About Life Insurance RevealedThe Life Insurance PDFs

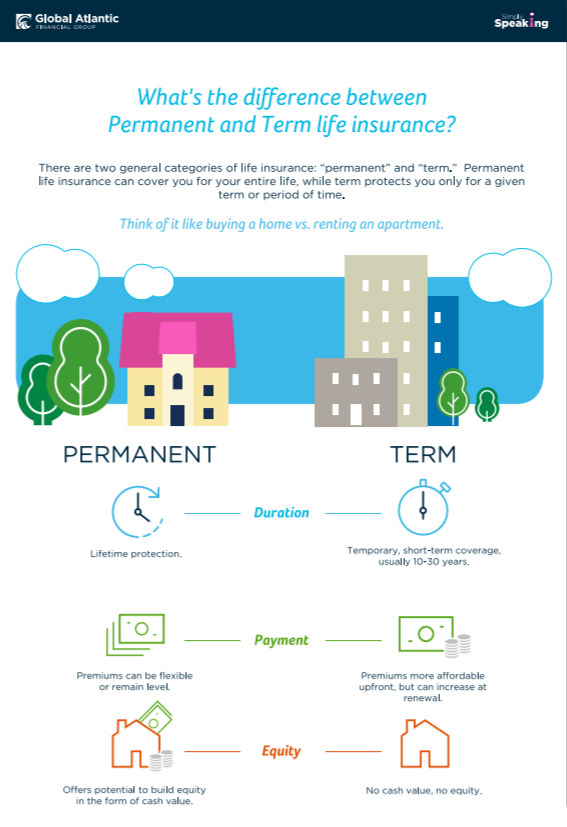

Normally, term insurance coverage are created for 1, 5, 10, or two decades, or to a specified age (such as 65). Term policies only pay a survivor benefit to the recipient if the insurance holder passes away throughout the specified term as well as so is a good option when the insurance holder needs protection for a short-lived time or a certain demand.There are a few various sorts of term life insurance policy plans: One of the most common,, is defined by level policy face amounts over the agreement term period, usually 10, 20, or three decades. The survivor benefit amount and also plan quantities are usually guaranteed to remain level during this time, regardless of the insured's wellness condition.

A policyholder may utilize these kinds of plans to cover financial responsibilities that lower gradually, such as a home loan. warranties the policyholder the right to renew at the end of the contract duration without evidence of insurability as long as the premium is paid. allows the insurance holder to convert a term insurance plan to a long-term insurance policy that will certainly develop money worths in later years.

Term insurance plan can likewise have a function which reimbursements component or all of the costs paid at the end of a level term duration if death benefits are not paid out. Plans with this feature are much more expensive because the insurance policy holder has the capability to receive cash money back. Entire life insurance policy gives a set amount of insurance protection over the life of the insured, with the benefits payable just upon the insured's death.

Not known Facts About Life Insurance

As mandated by state legislation, entire life plans have nonforfeiture values payable in cash money or some various other form of insurance in case the plan lapses from nonpayment of required costs or the plan proprietor decides to surrender the insurance coverage. There are a number of sorts of entire life insurance policy policies. A does not pay rewards to the plan proprietor, but rather the insurance provider sets the level costs, fatality benefits as well as cash abandonment worths at the time of purchase.

Universal life insurance coverage is permanent life insurance coverage combining term insurance policy with a money account earning tax-deferred passion. Under most contracts, costs and/or survivor benefit can rise and fall at insurance policy holder discretion. The policy stays in result as long as the cash money worth is enough to cover the cost of insurance coverage and also finances can be taken versus the cash money value of the plan.

The passion accumulated under these agreements are not ensured as well as might in truth be unfavorable since interest is a function of the modification in the market worth of the different account properties. Recent years have seen the increase of, which have both fixed and also variable features. Under these policies, passion credit histories are linked to exterior index of financial investments, such as bonds or the S&P 500.

The 5-Minute Rule for Life Insurance

Life insurance coverage and are controlled by state insurance commissioners. The NAIC encourages states to adopt and also policies developed to educate as well as secure insurance coverage consumers. his response The NAIC Life Insurance Policy (# 580) needs insurers to supply to buyers of life insurance policy details that will boost the buyer's understanding of the plan and capability to select the most ideal plan for the purchaser's requirements.

Term life insurance policy is meant to supply lower-cost protection for Continue a certain period as well important source as normally have lower costs in the very early years, but do not construct up a cash worth that you can accessibility. Term life policies may include a stipulation that enables protection to proceed (renew) at the end of the term, also if your health condition has altered.

These policies also have cost savings or financial investment functions, which make it possible for plan owners to get cash from the plan while they're still active - life insurance. Entire life, global life, and also variable life are kinds of cash value policies. In some money worth plans, the values are reduced in the early years yet develop later on.

Life Insurance Can Be Fun For Anyone

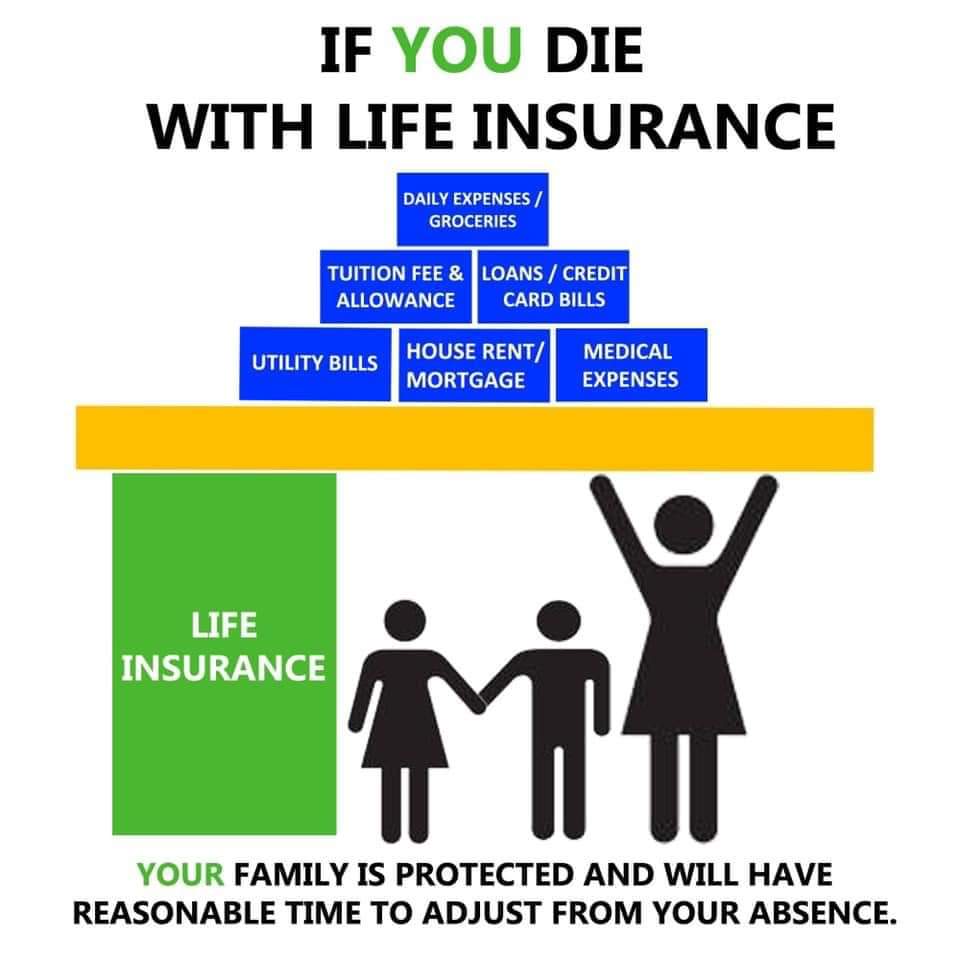

A term life plan may be one of the most easy, straightforward choice permanently insurance coverage for many individuals. A survivor benefit can replace the earnings you would have made during a collection period, such as until a small aged reliant matures. Or, it can settle a big financial obligation, such as a home mortgage, to make sure that an enduring spouse or various other heirs won't need to bother with making the settlements.

There are different types of term life, including level term and also decreasing term. life insurance policy offers a fatality benefit that stays the exact same throughout the plan. life insurance. life insurance policy lowers prospective survivor benefit over the plan's term, generally in 1 year increments. For more information on the various sorts of term life insurance policy, click right here.